How to Login and start Trading Digital Options on Quotex

Quotex is a leading platform for digital options trading, offering a range of financial instruments for both novice and experienced traders. Once you've created an account, the next step is to log in and start trading.

This guide will walk you through the process of logging into your Quotex account and provide essential steps for beginning your journey in digital options trading.

This guide will walk you through the process of logging into your Quotex account and provide essential steps for beginning your journey in digital options trading.

How to Login to Quotex

Login to Quotex using Google

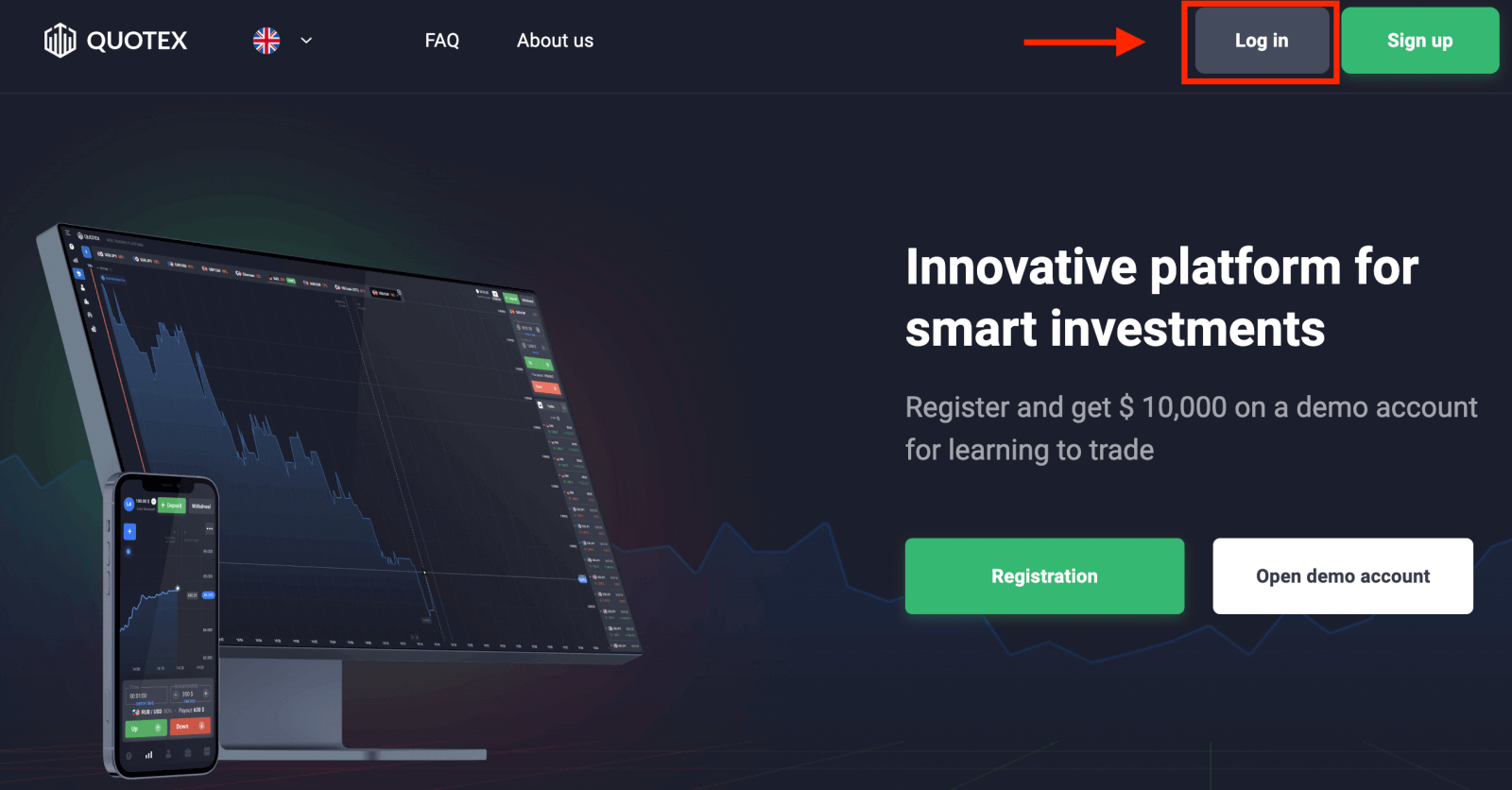

Users with a Google account can use their account to log in to Quotex. Click "Log in" on the main screen.

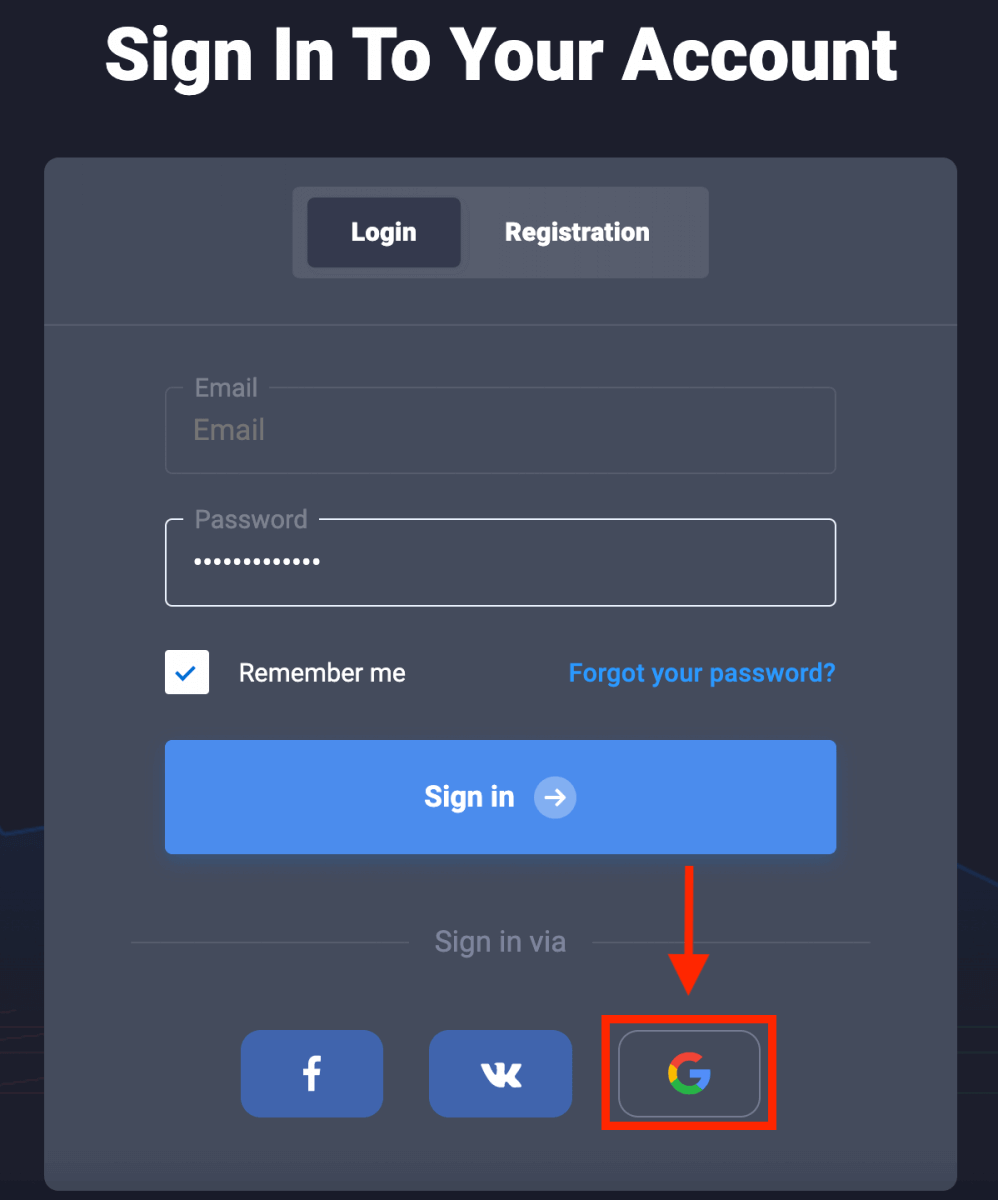

1. Click on the Google button.

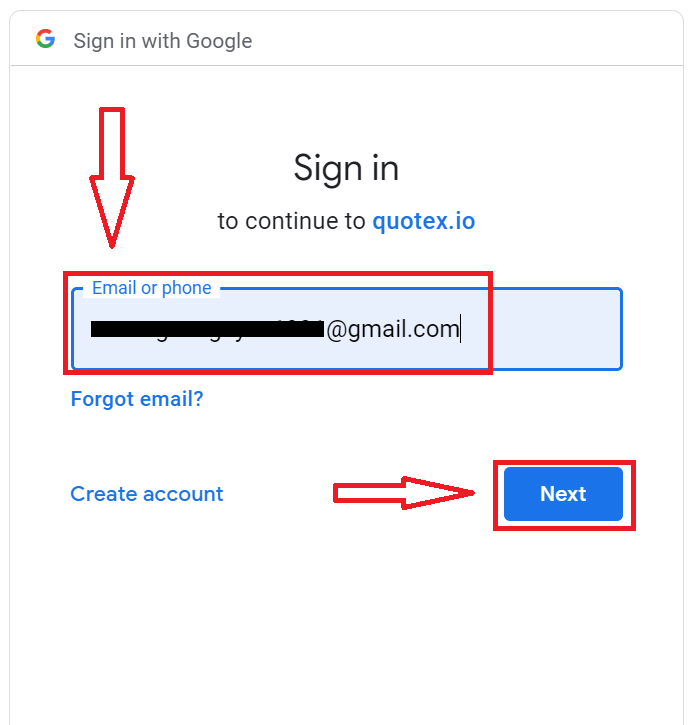

2. Google account sign-in window will be opened, where you will need to enter your Email address or Phone and click on “Next”.

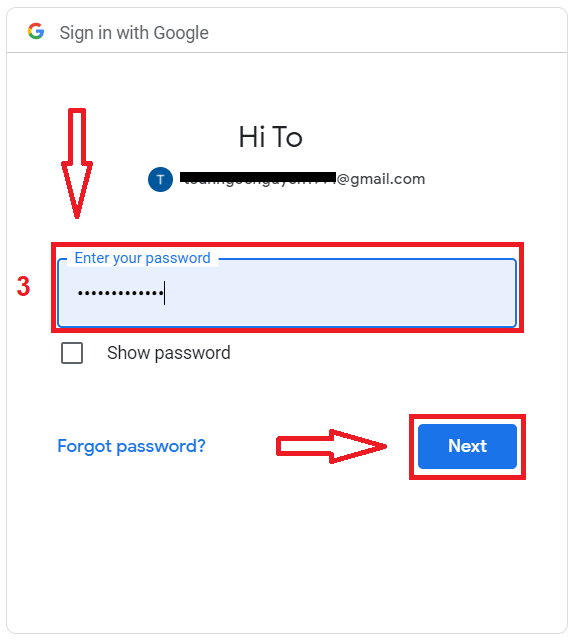

3. Then enter the password for your Google account and click “Next”.

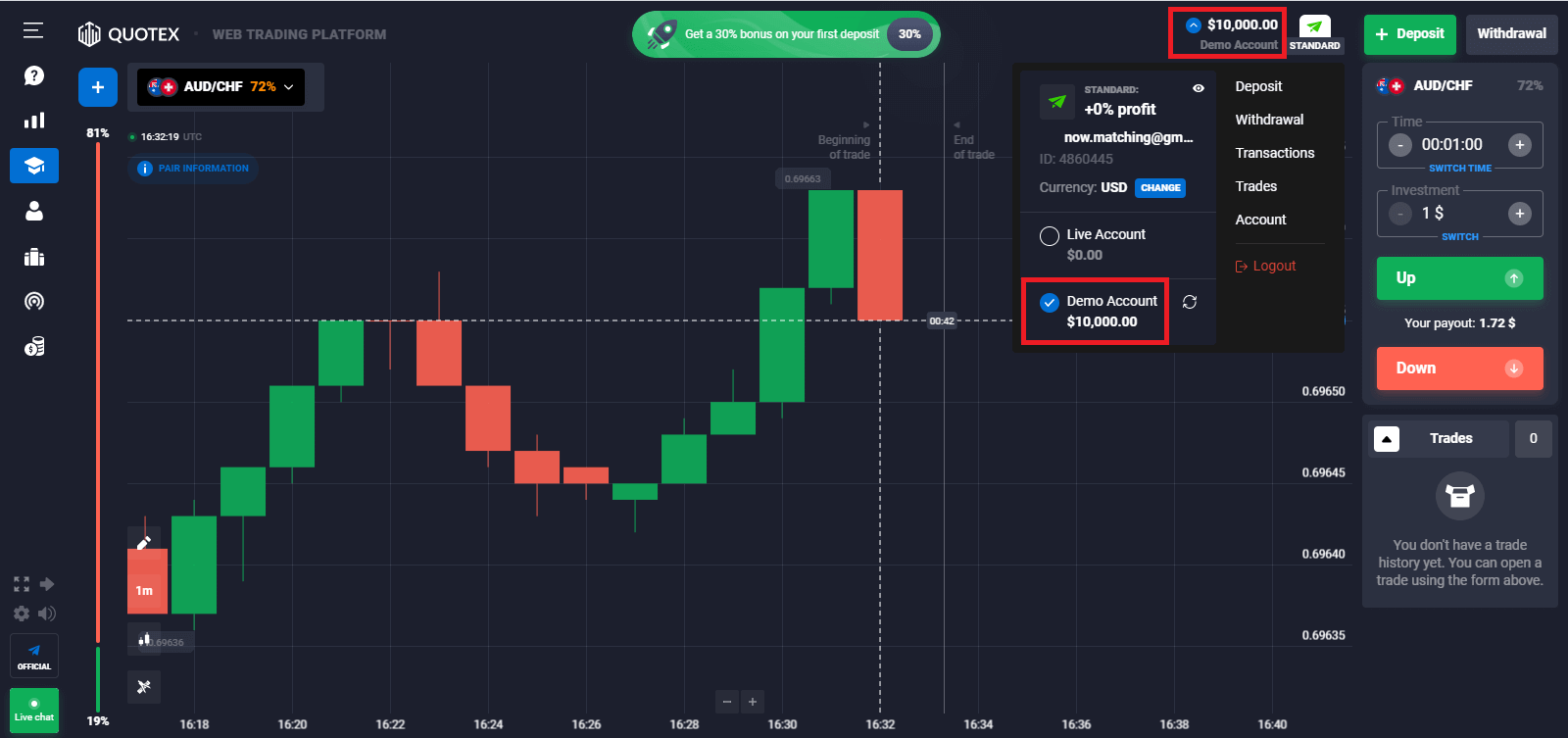

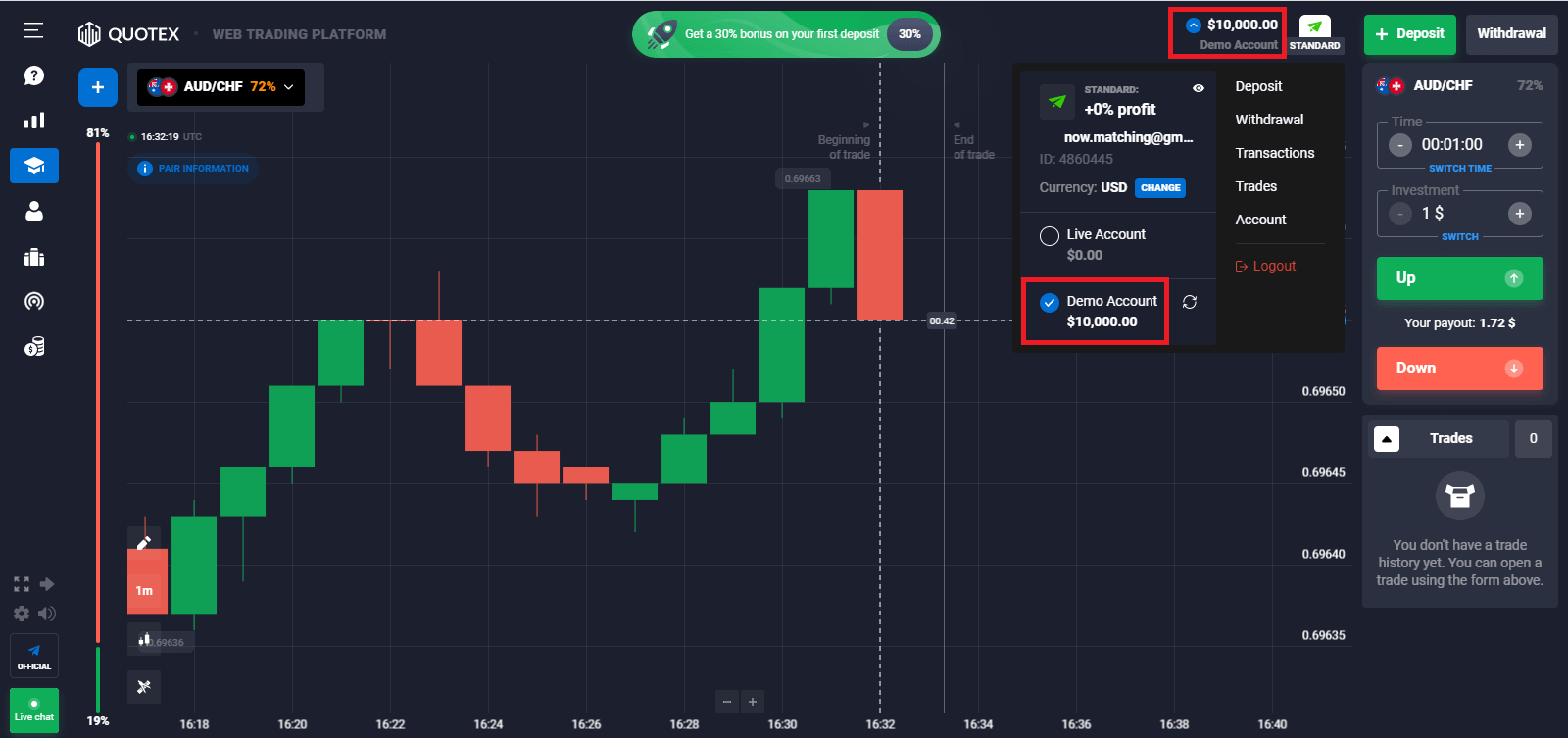

After that, You have successfully logged in to Quotex and you have $10,000 in Demo Account.

If you want to trade on Real account, you can deposit and start trading with real money.

How to Deposit money in Quotex

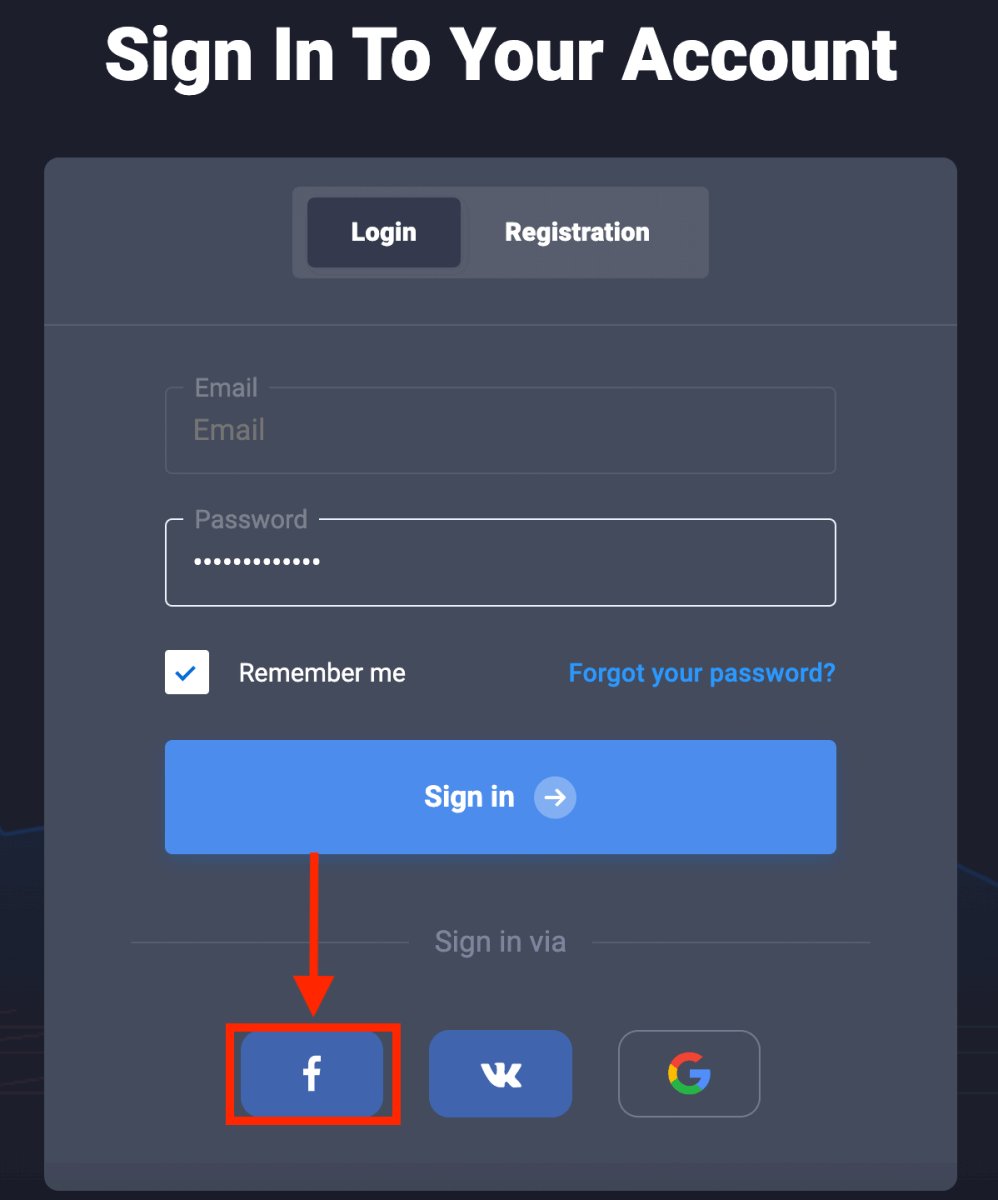

Login to Quotex using Facebook

A user may log in to Quotex via the Facebook account that has been linked to the registered email.To log in via this method:

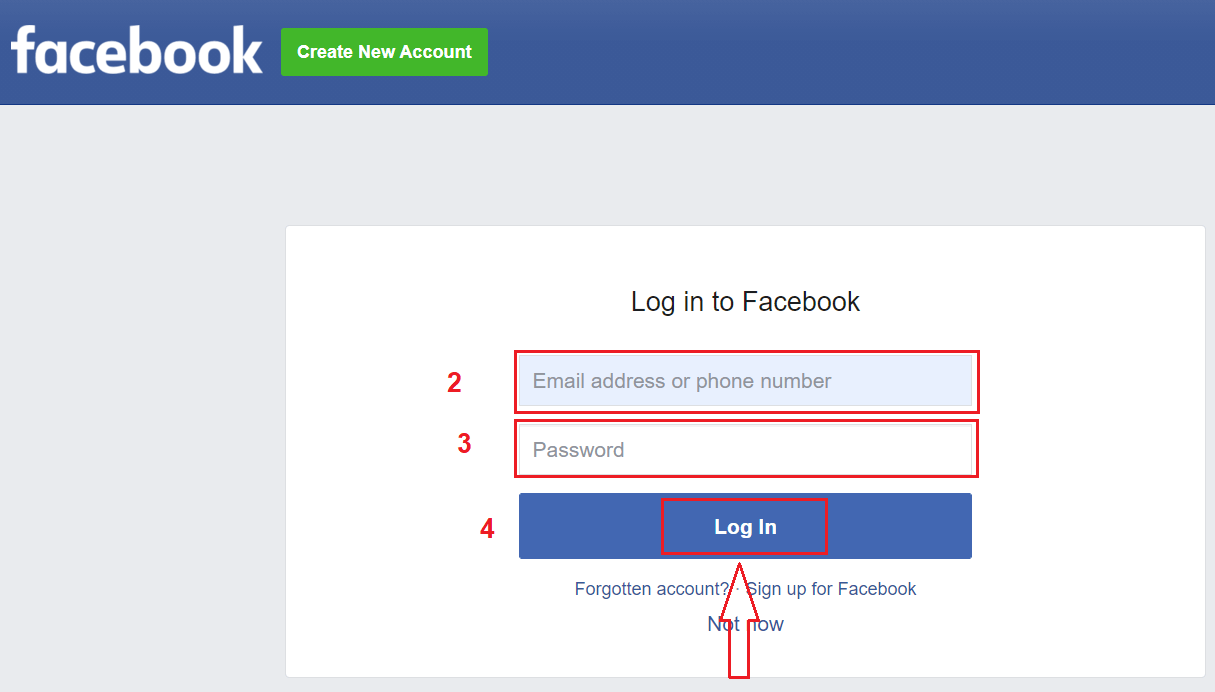

1. Open the Quotex login page and click on the Facebook button.

2. The Facebook login window will be opened, where you will need to enter the email address or phone you used to register on Facebook.

3. Enter the password from your Facebook account.

4. Click on “Log In”.

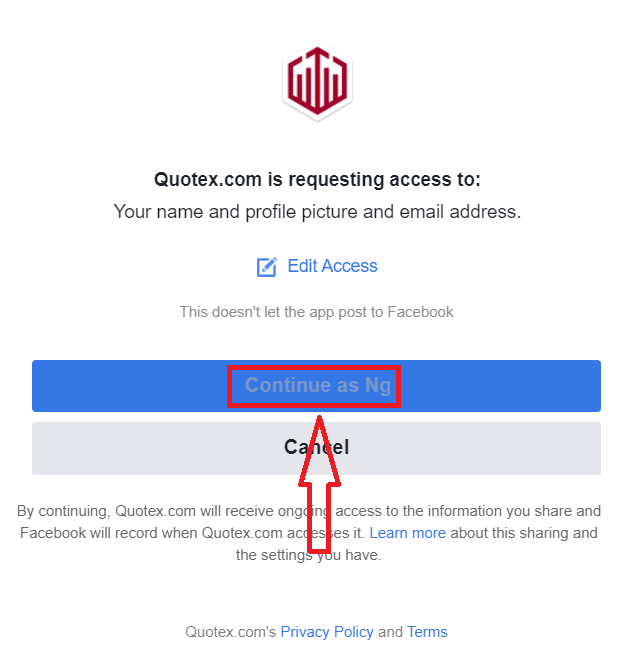

Once you’ve clicked on the “Log in” button, Quotex is requesting access to Your name, profile picture, and email address. Click Continue...

After that, you will be automatically redirected to the Quotex platform.

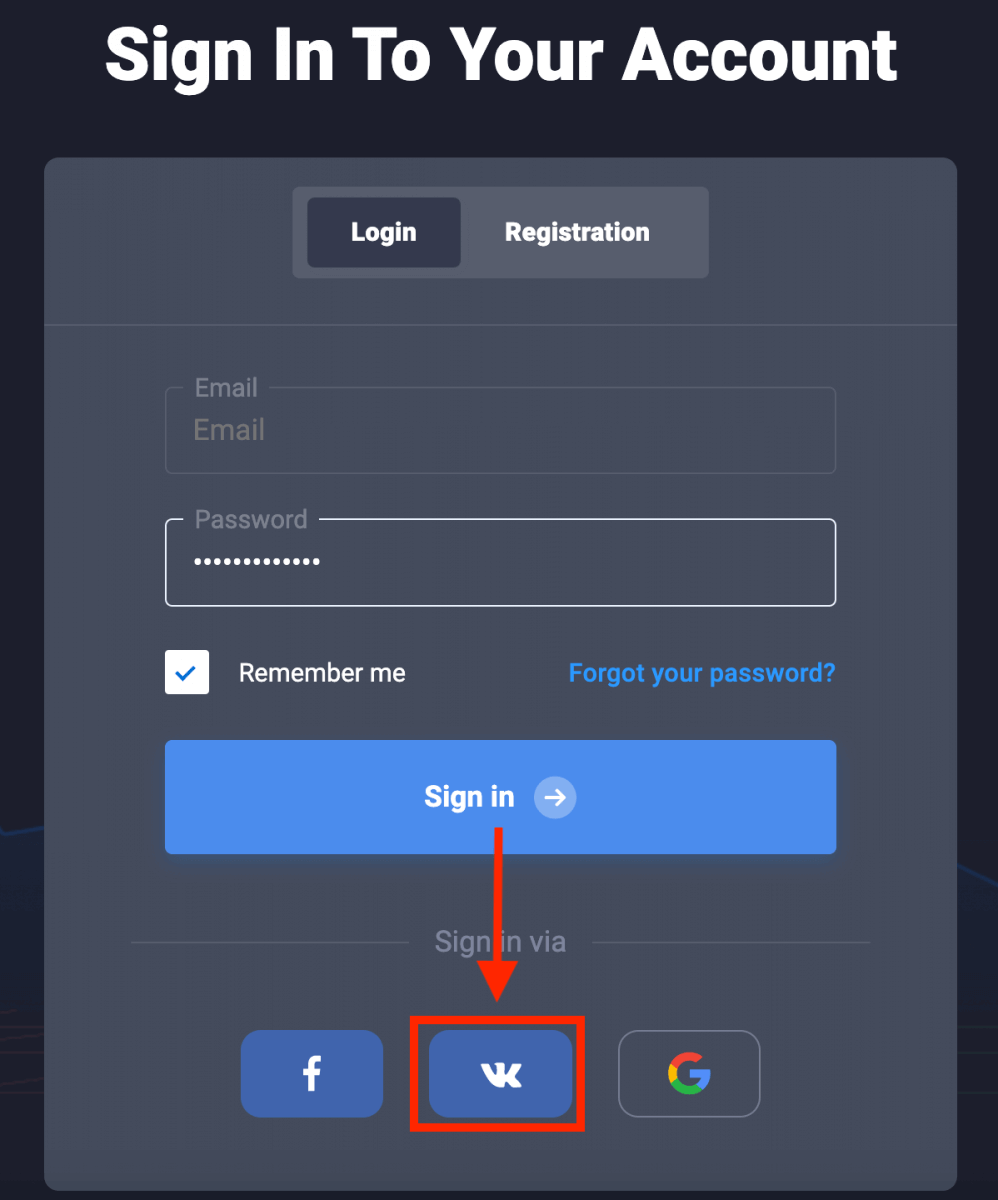

Login to Quotex using VK

With Quotex, you as well have an option to log into your account through VK. To do that, you just need to:1. Click on the VK button.

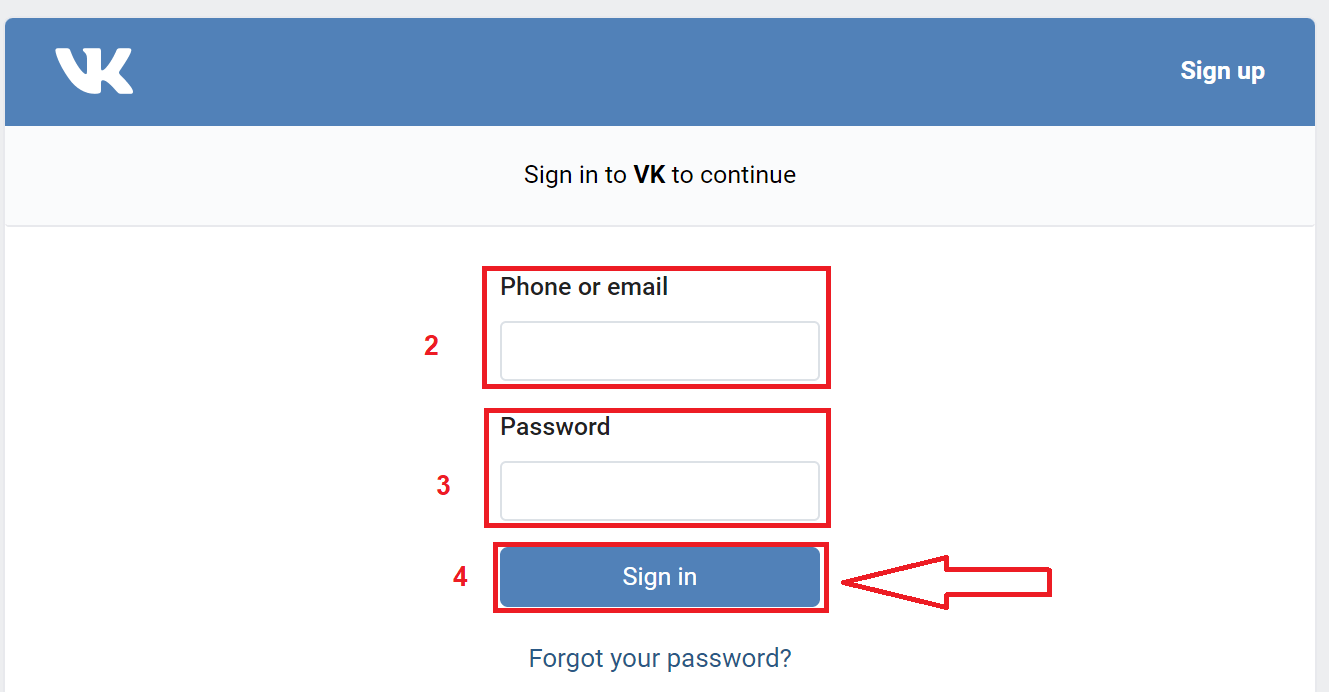

2. VK sign-in page will be opened, where you will have to enter the email you used to register your VK account.

3. Enter the password from your VK account.

4. Finally, click on “Sign In”.

After that, you will be automatically redirected to the Quotex platform.

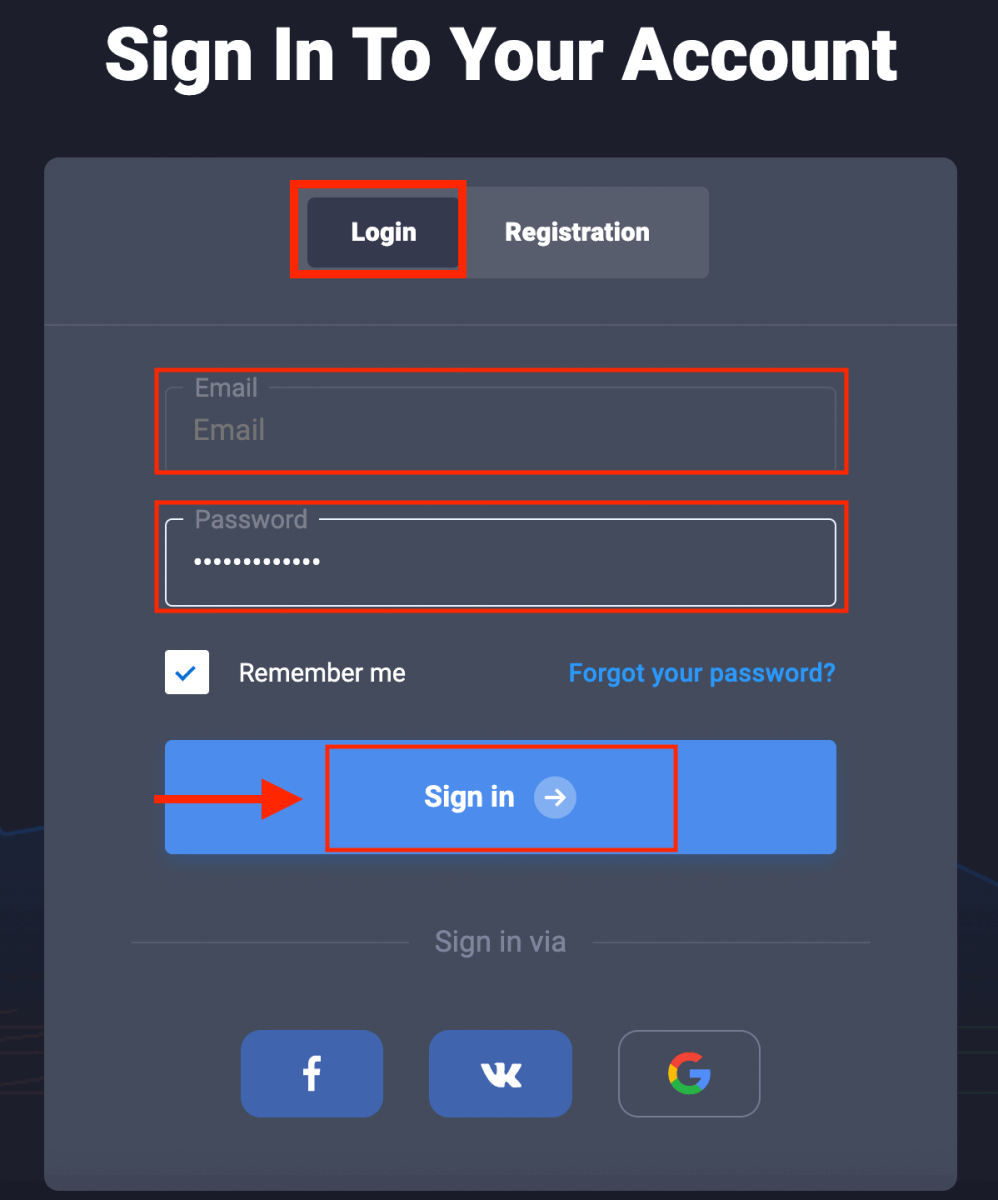

Login to Quotex using Email

Logging in to Quotex will require the user two essential details:- An email

- A password

You have successfully logged in to Quotex and you have $10,000 in Demo Account.

You can deposit and start trading with Real money.

How to Deposit money in Quotex

Login to Quotex through the Android App

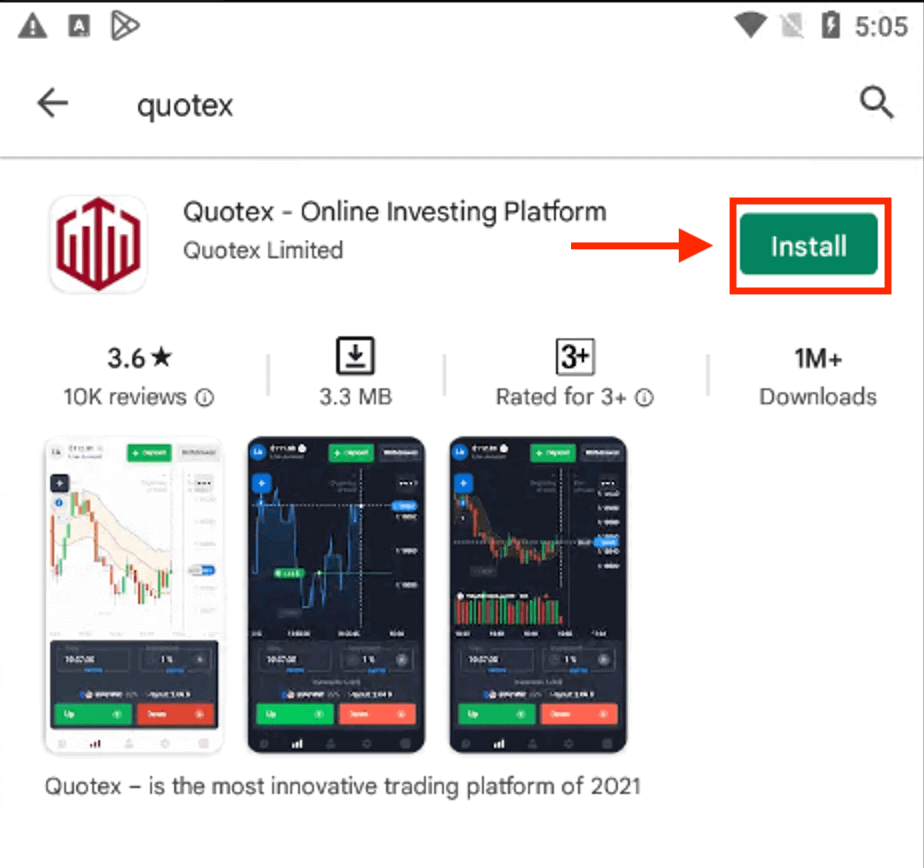

If you have an Android mobile device you will need to download the Quotex mobile app from Google Play or here. Simply search for “Quotex - Online Investing Platform” app and download it on your device.

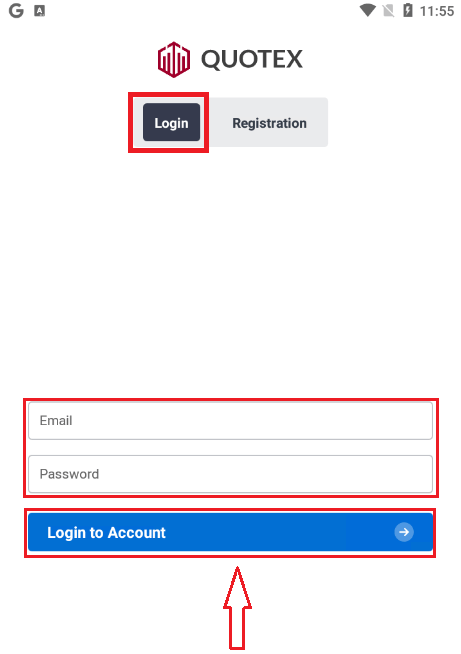

It is easy to log into your Quotex account through Android App too. In order to do this, follow these simple steps:

1. Enter the email address, that you used to open your Quotex account.

2. Enter the password from your Quotex account.

3. Click on “Login to Account”.

Now You have $10,000 in Demo Account, you can also trade on a real account after depositing.

How to Deposit money in Quotex

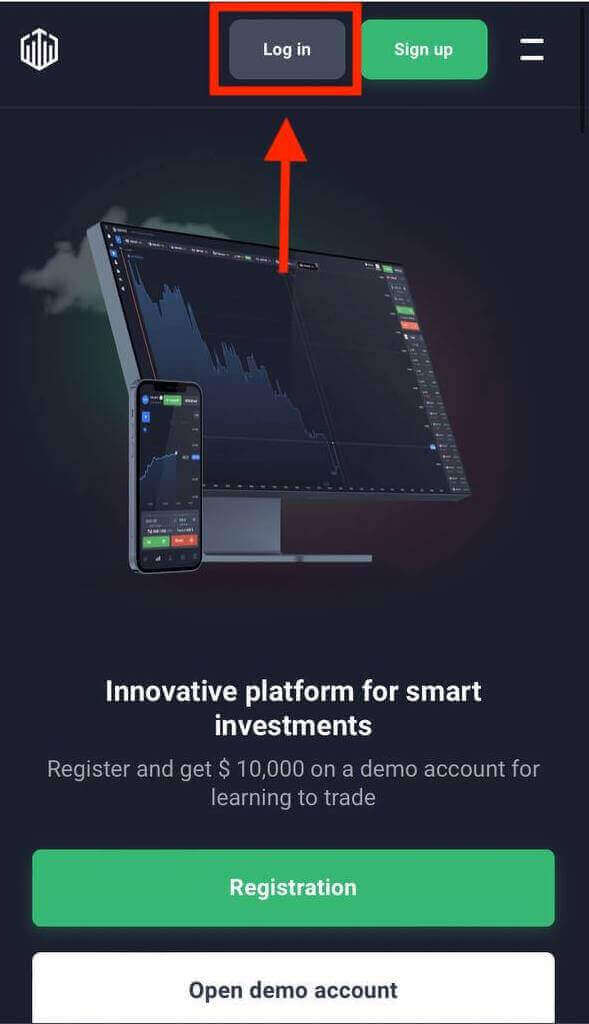

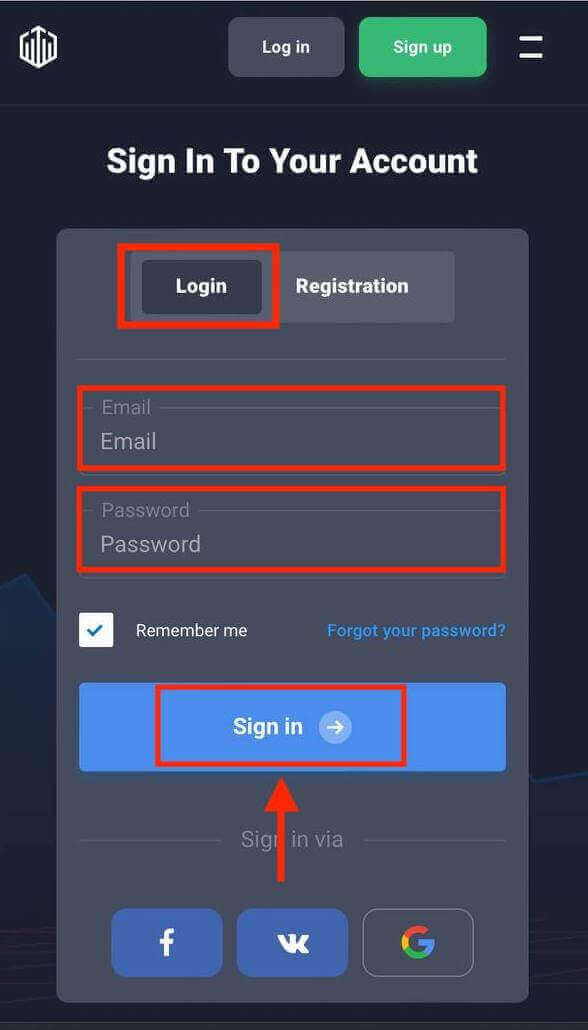

Login on Quotex Mobile Web

If you want to trade on the mobile web version of Quotex trading platform, you can easily do it. Initially, open up your browser on your mobile device, and visit our broker’s website. Click "Log in".

Enter your email and password, then click on the “Sign in” button.

Here you are! Now you are able to trade from the mobile web version of the platform. The mobile web version of the trading platform is exactly the same as a regular web version of it. Consequently, there won’t be any problems with trading and transferring funds.

You also have $10,000 in Demo Account, you can also trade on a real account after depositing.

Forgot Password in Quotex

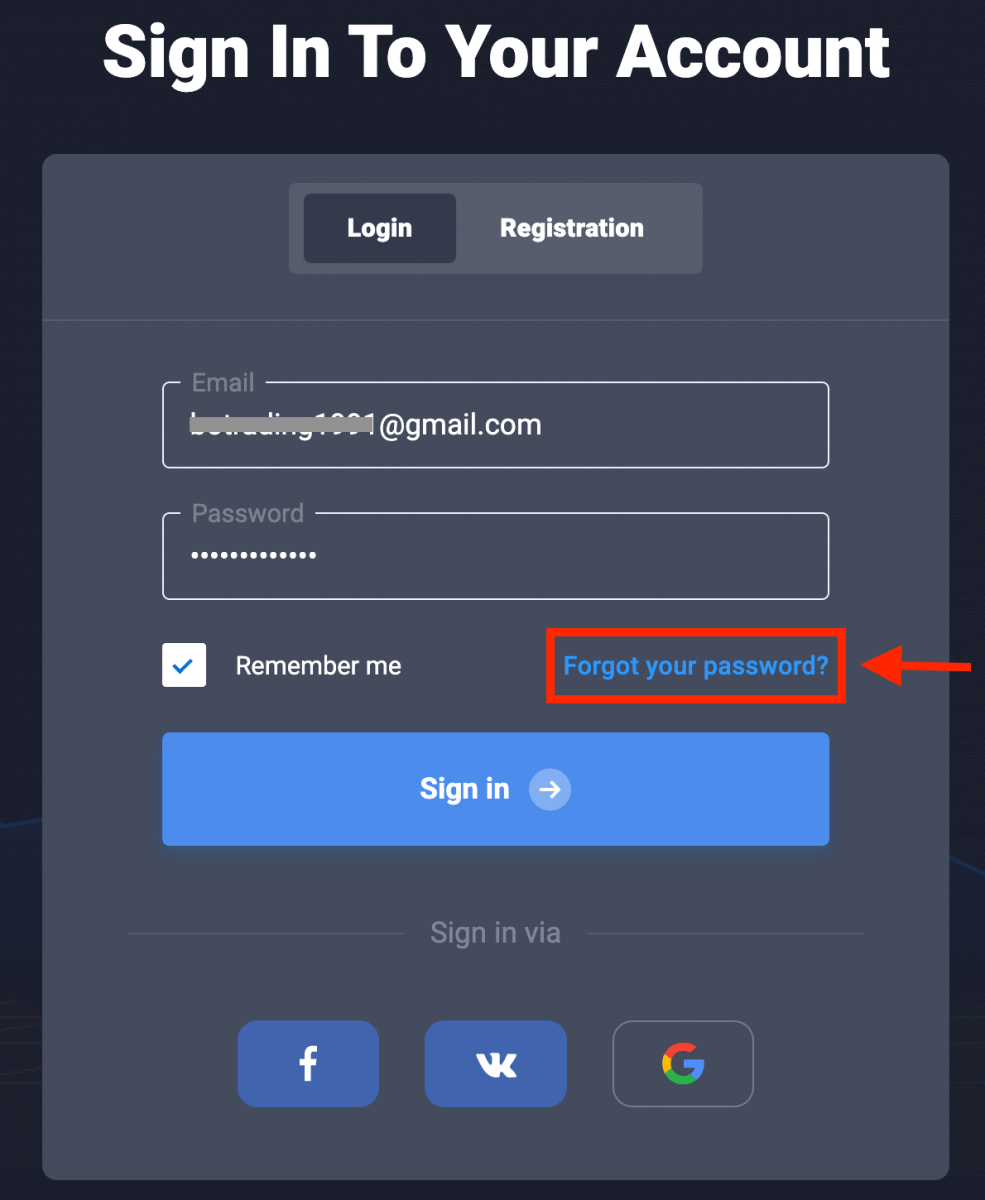

Don’t worry if you can’t log into the platform, you might just be entering the wrong password. You can come up with a new one.To do that, click on the "Forgot your password"

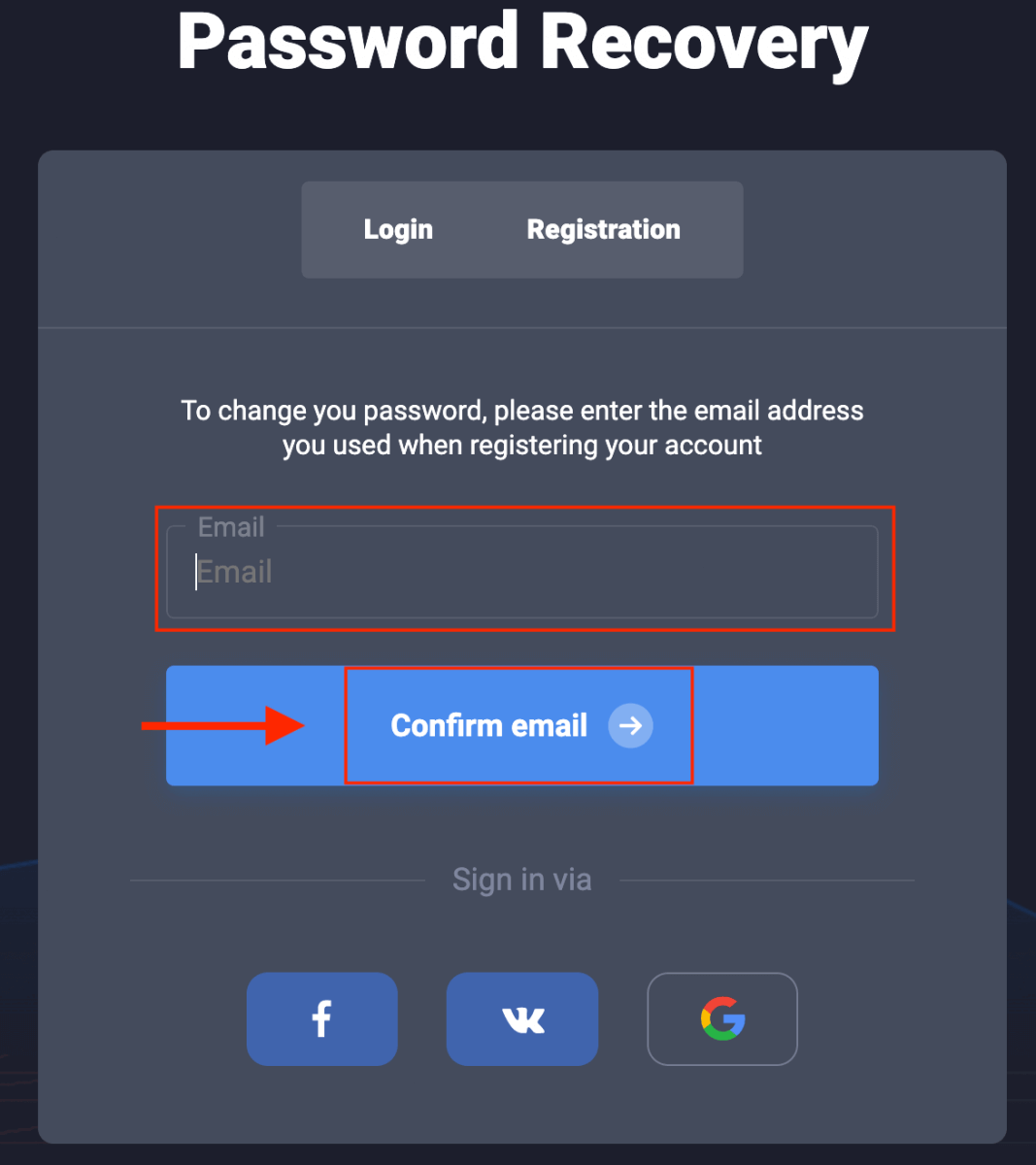

In the new window, enter the email you used during sign-up and click the "Confirm Email" button.

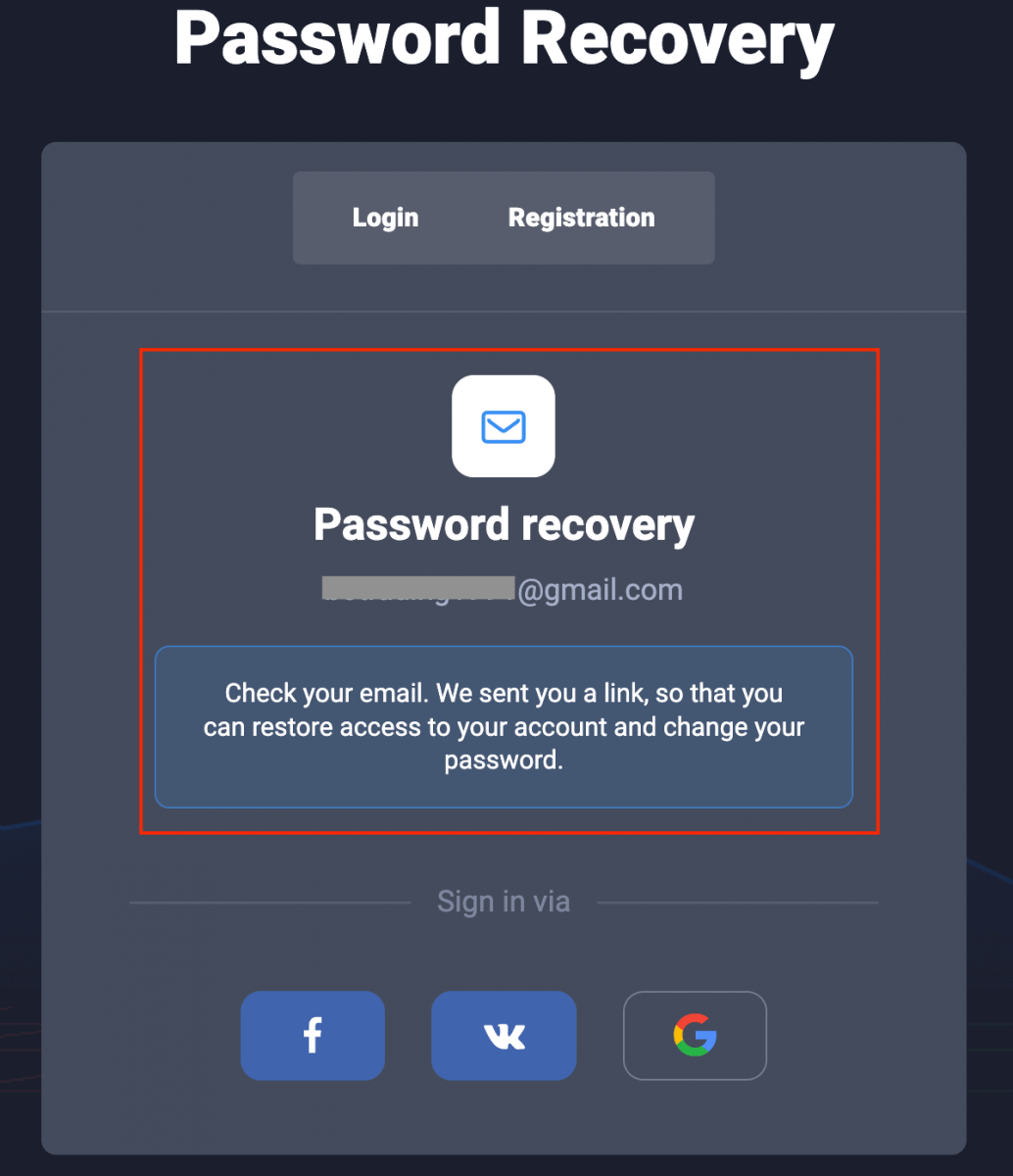

You’ll get an email with a link to change your password right away.

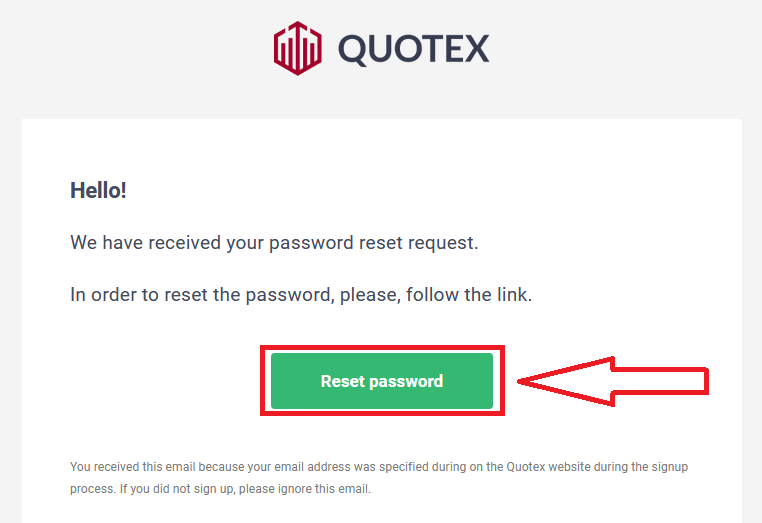

The most difficult part is over, we promise! Now just go to your inbox, open the email, and click the "Reset password" button.

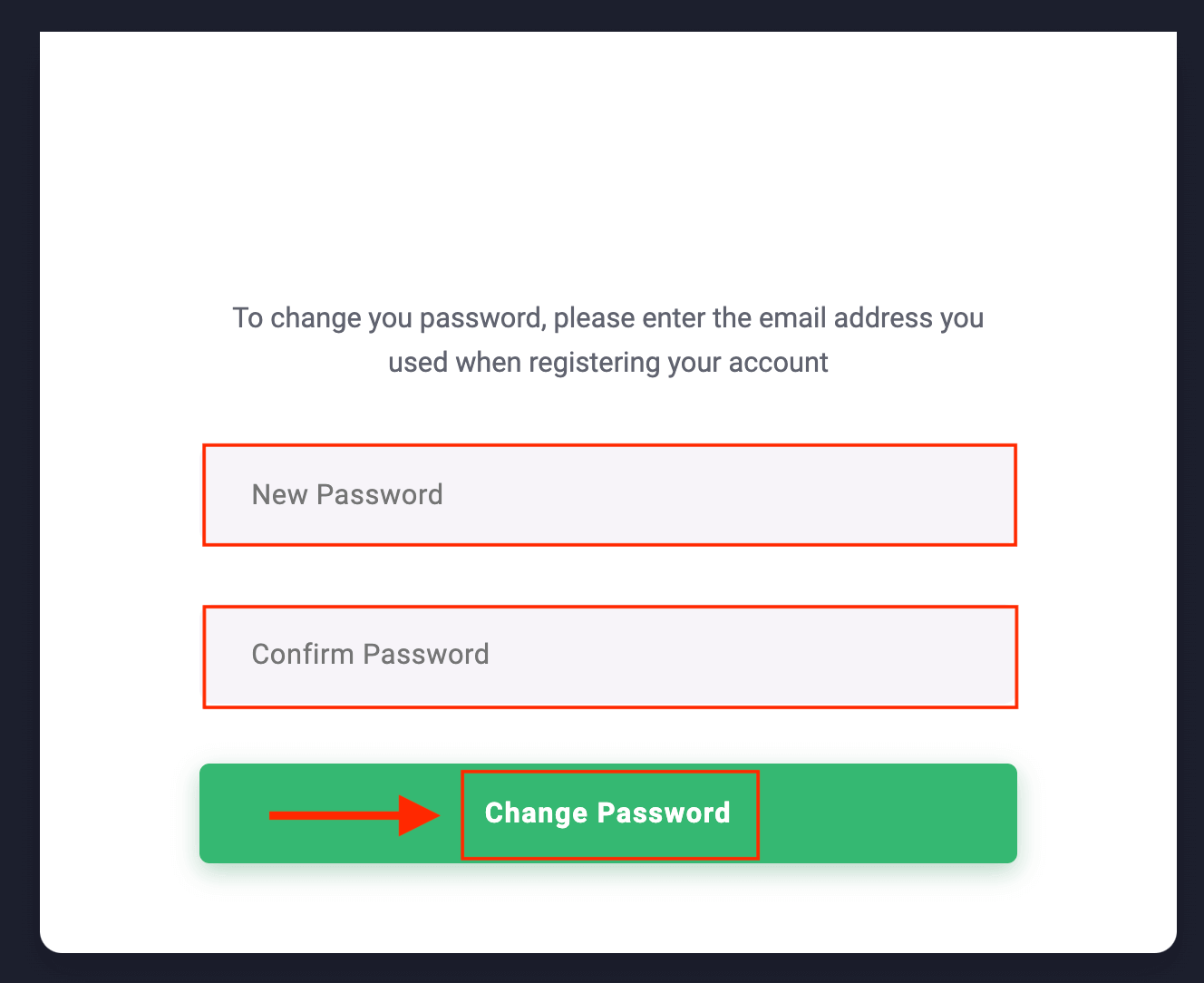

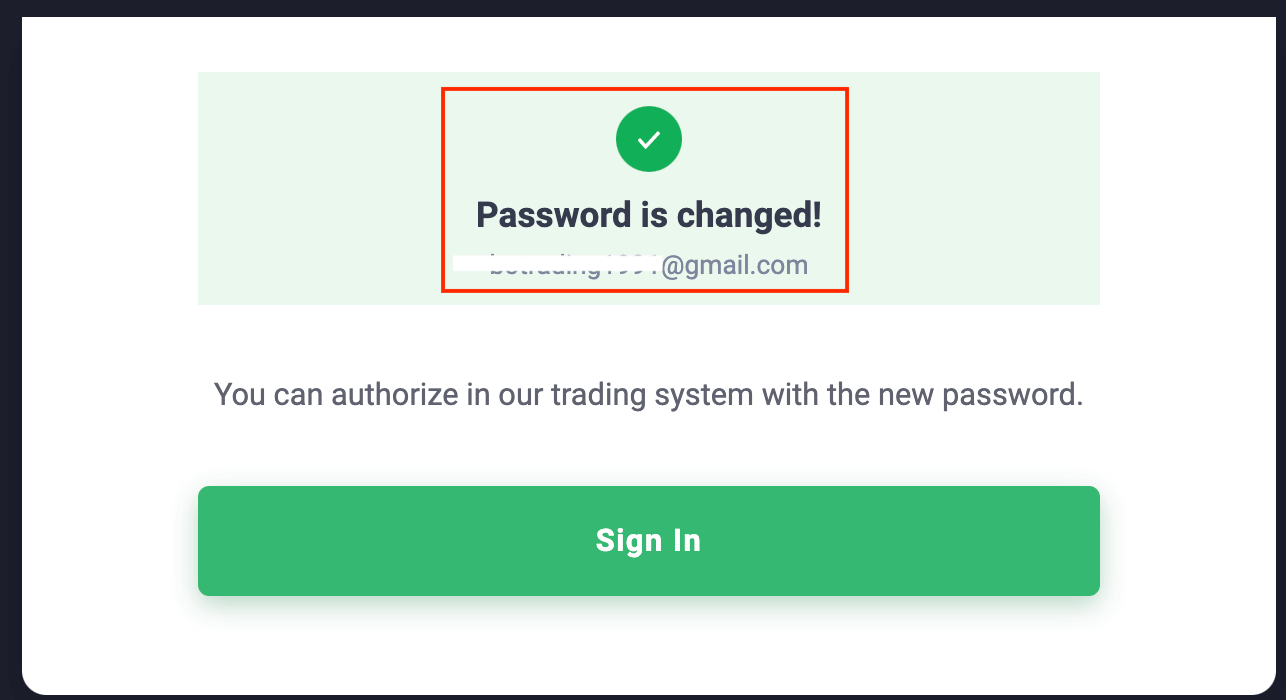

The link from the email will lead you to a special section on the Quotex website. Enter your new password here twice and click the "Change password" button.

After entering "Password" and "Confirm password". A message will appear indicating that the password has been changed successfully.

That’s it! Now you can log into the Quotex platform using your username and new password.

How to start Trading Digital Options on Quotex

What are digital options?

Option is a derivative financial instrument based on any underlying asset, such as a stock, a currency pair, oil, etc.DIGITAL OPTION - a non-standard option that is used to make a profit on price movements of such assets for a certain period of time.

A digital option, depending on the terms agreed upon by the parties to the transaction, at a time determined by the parties, brings a fixed income (the difference between the trade income and the price of the asset) or loss (in the amount of the value of the asset).

Since the digital option is purchased in advance at a fixed price, the size of the profit, as well as the size of the potential loss, are known even before the trade.

Another feature of these deals is the time limit. Any option has its own term (expiration time or conclusion time).

Regardless of the degree of change in the price of the underlying asset (how much it has become higher or lower), in case of winning an option, a fixed payment is always made. Therefore, your risks are limited only by the amount for which the option is acquired.

What are the varieties of digital options?

Making an option trade, you must choose the underlying asset that will underlie the option. Your forecast will be carried out on this asset.

Simply, buying a digital contract, you are actually betting on the price movement of such an underlying asset.

An underlying asset is an “item” whose price is taken into account when concluding a trade. As the underlying asset of digital options, the most sought-after products on the markets usually act. There are four types of them:

- securities (shares of world companies)

- currency pairs (EUR / USD, GBP / USD, etc.)

- raw materials and precious metals (oil, gold, etc.)

- indices (SP 500, Dow, dollar index, etc.)

There is no such thing as a universal underlying asset. When choosing it, you can only use your own knowledge, intuition, and various kinds of analytical information, as well as market analysis for a particular financial instrument.

How to Trade digital options?

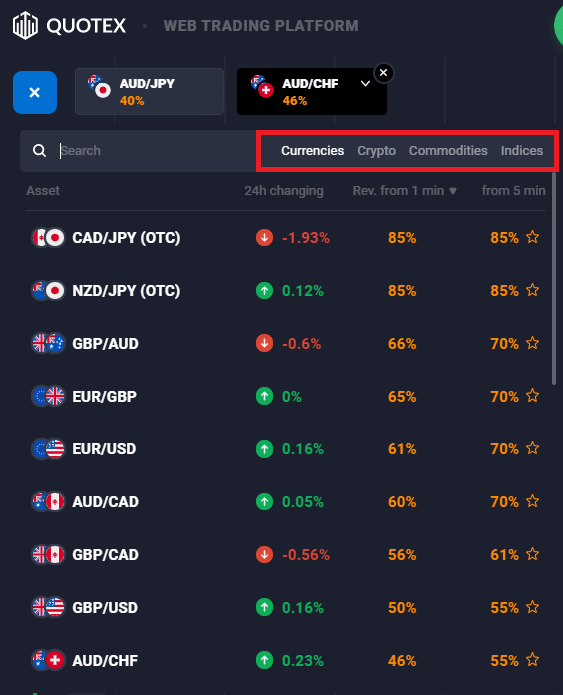

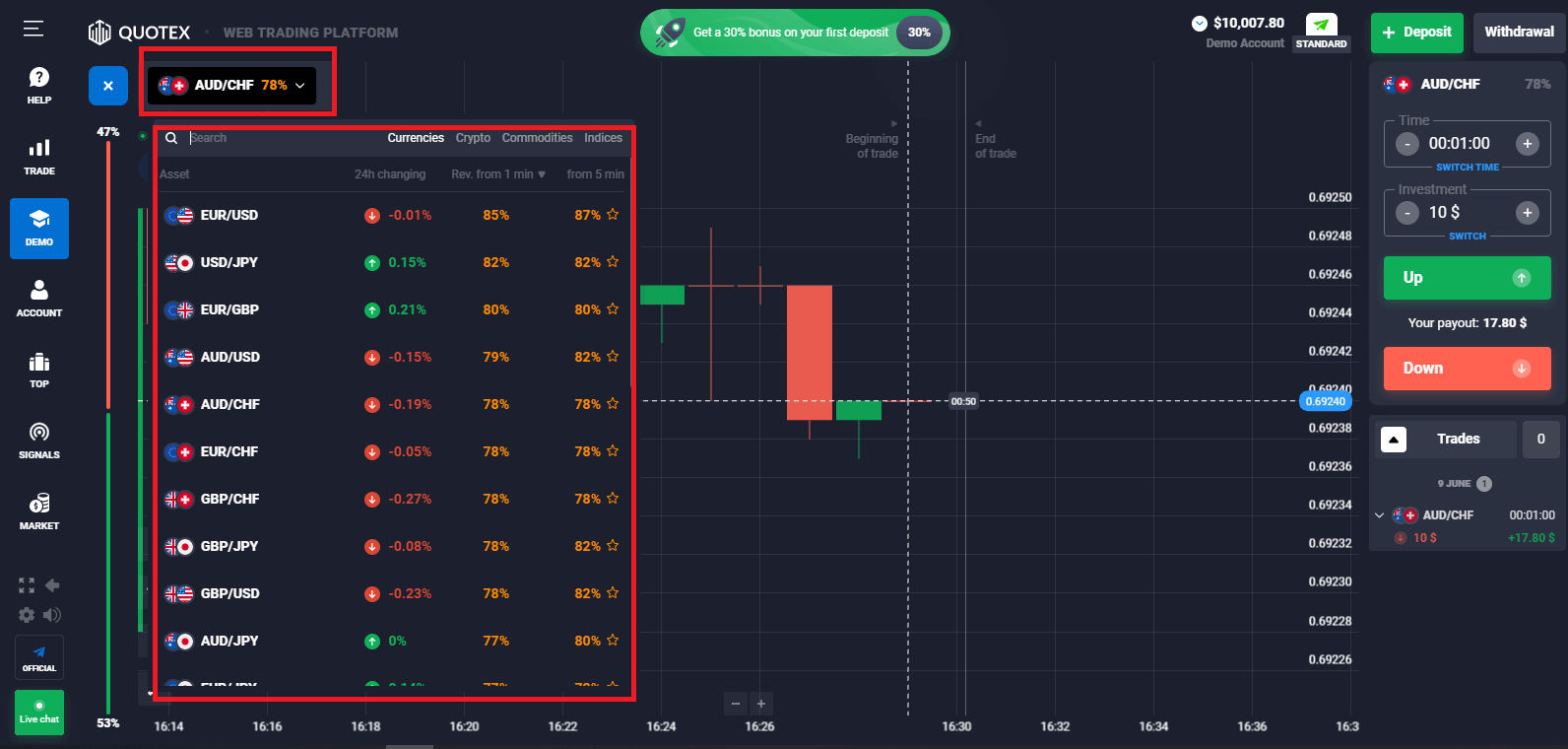

1. Choose asset for trading: Currencies, Commodities, Crypto or Indices

- You can scroll through the list of assets. The assets that are available to you are colored white. Click on the assest to trade on it.

- You can trade on multiple assets at once. Click on the “+” button left from the asset section. The asset you choose will add up.

The percentage next to the asset determines its profitability. The higher the percentage – the higher your profit in case of success.

Example. If a $10 trade with a profitability of 80% closes with a positive outcome, $18 will be credited to your balance. $10 is your investment, and $8 is a profit.

Some asset’s profitability may vary depending on the expiration time of a trade and throughout the day depending on the market situation.

All trades close with the profitability that was indicated when they were opened.

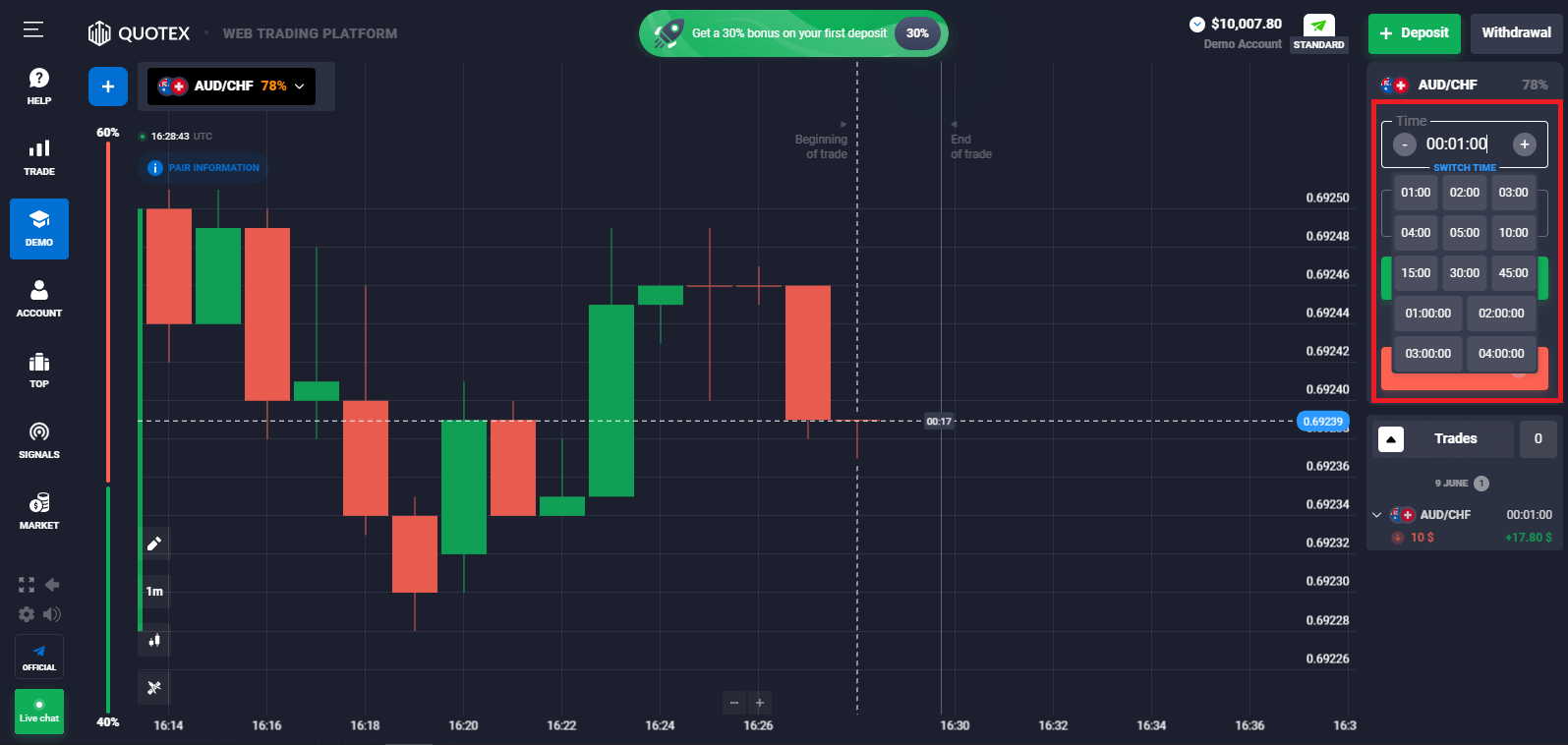

2. Choose an Expiration Time

The expiration period is the time after which the trade will be considered completed (closed) and the result is automatically summed up.

When concluding a trade with digital options, you independently determine the time of execution of the transaction (1 minute, 2 hours, month, etc.).

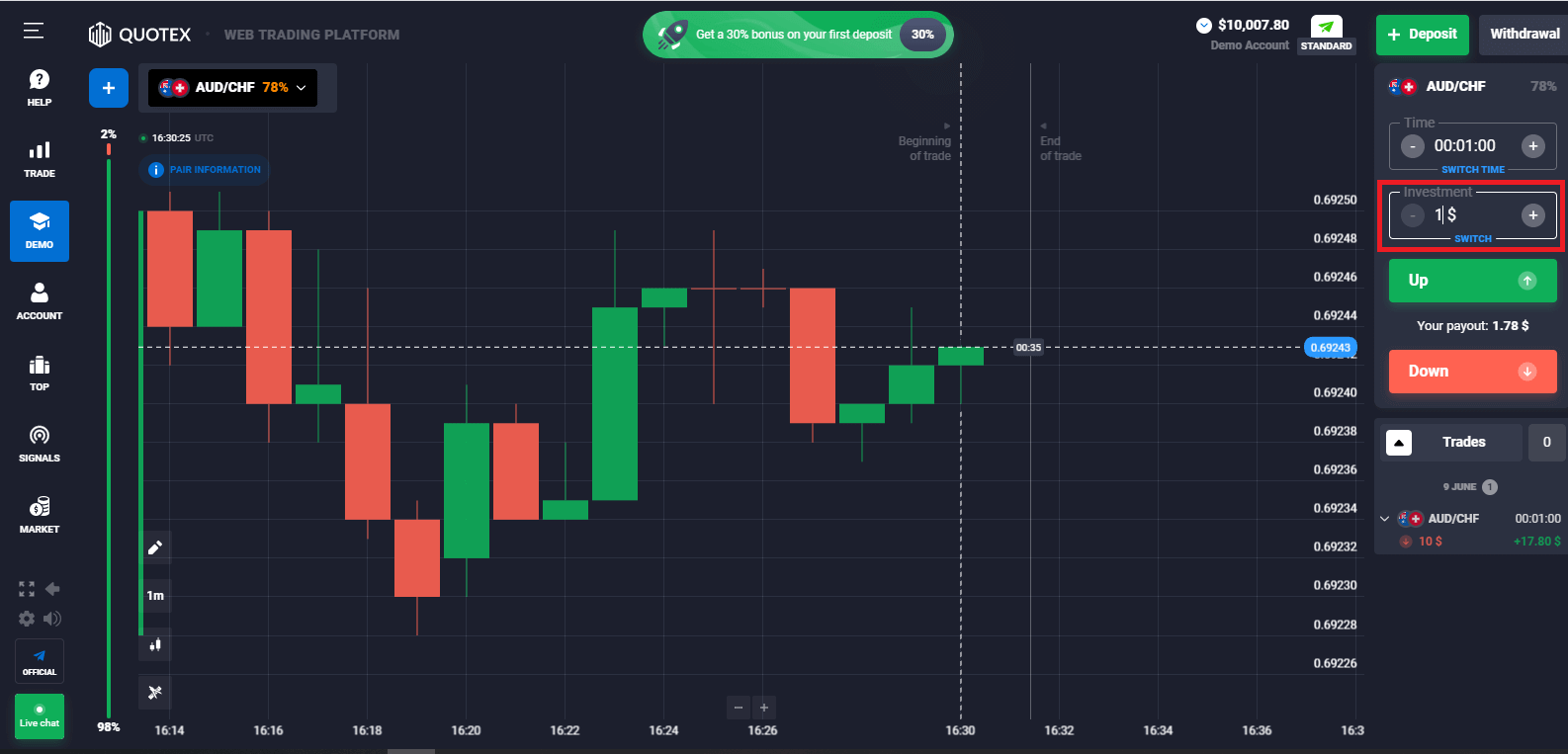

3. Set the amount you’re going to invest. The minimum amount for a trade is $1, the maximum – $1000, or an equivalent in your account currency. We recommend you start with small trades to test the market and get comfortable.

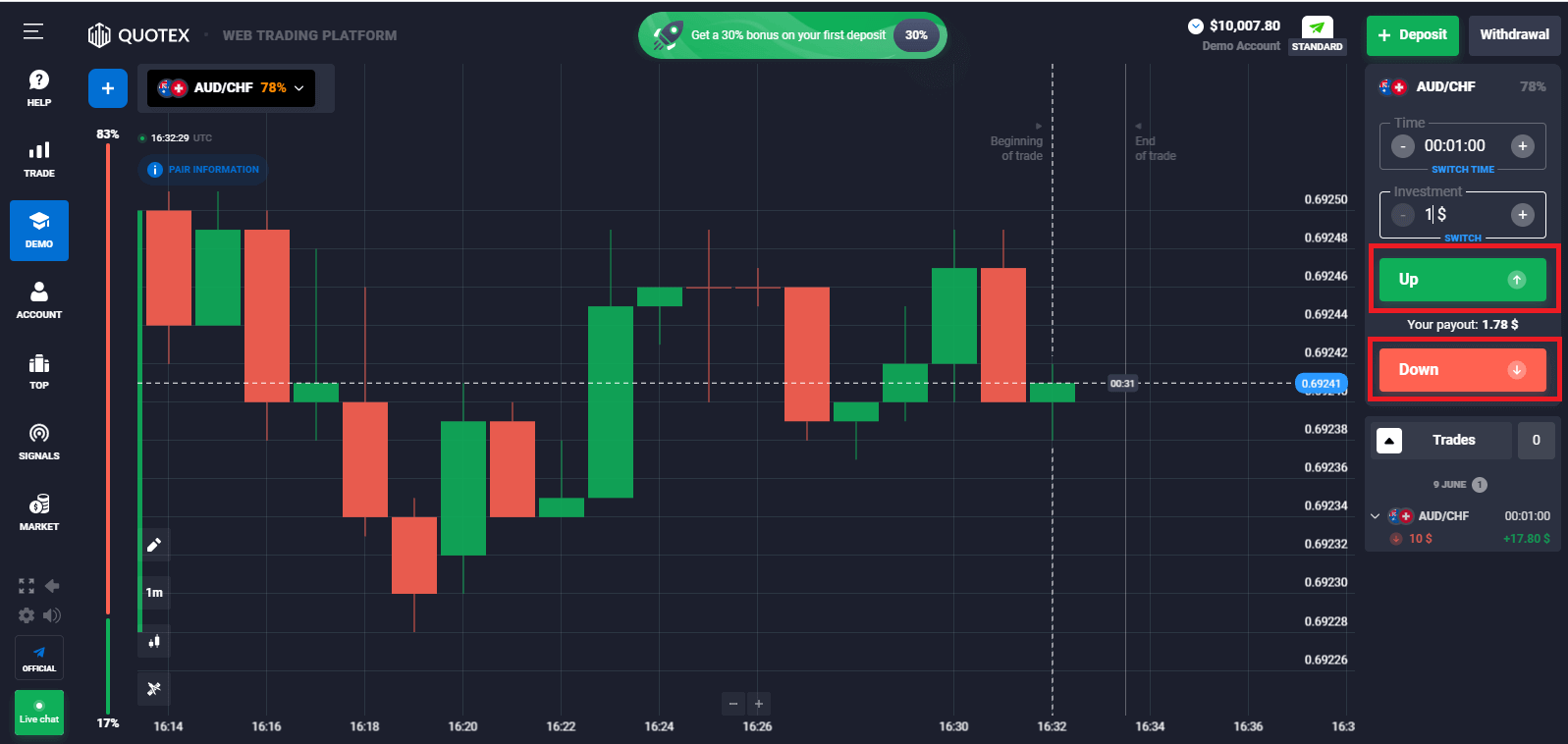

4. Analyze the price movement on the chart and make your forecast. Choose Up (Green) or Down (Red) options depending on your forecast. If you expect the price to go up, press "Up" and if you think the price to go down, press "Down"

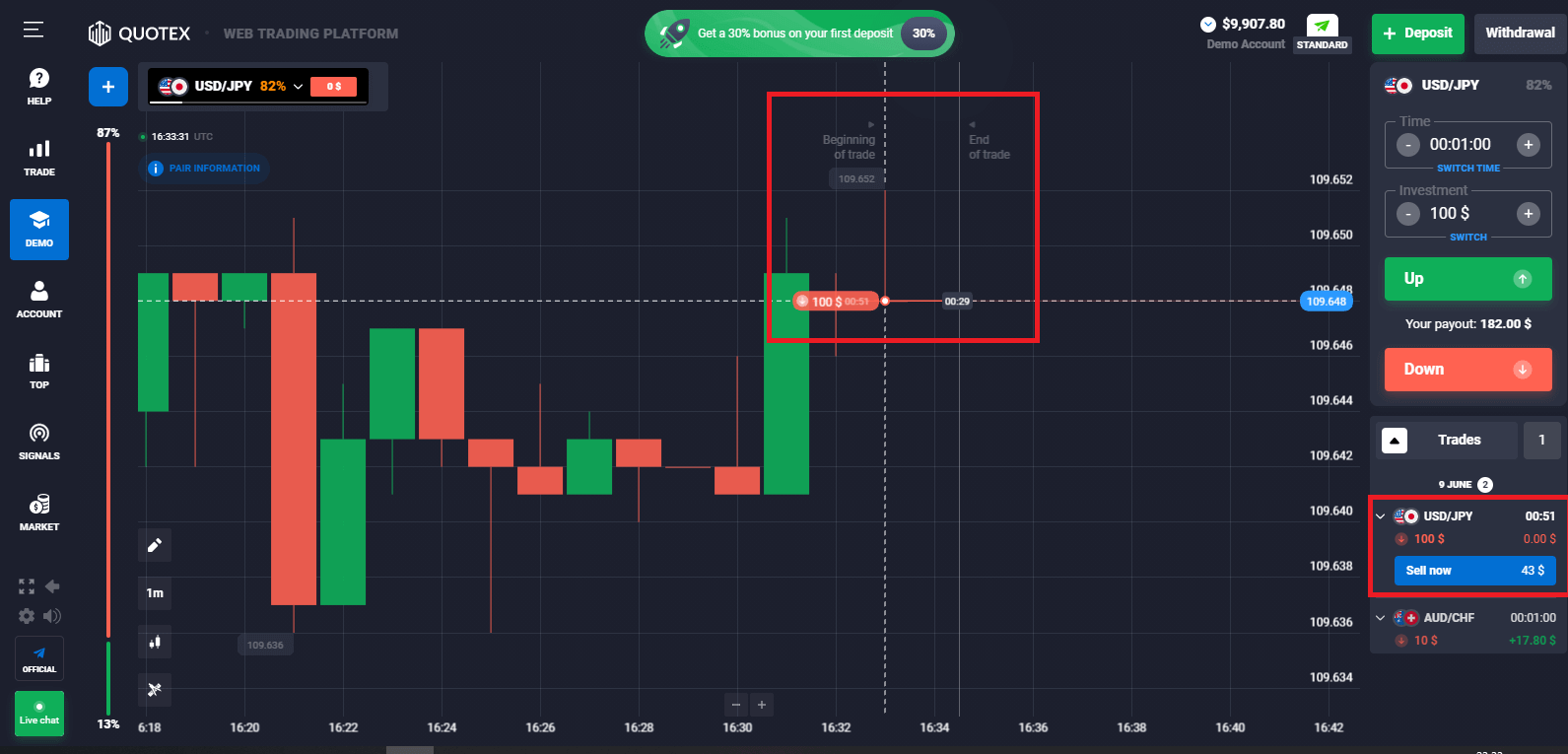

5. Wait for the trade to close to find out whether your forecast was correct. If it was, the amount of your investment plus the profit from the asset would be added to your balance. If your forecast was incorrect – the investment would not be returned.

You can monitor the Progress of your Order under The Trades

Frequently Asked Questions (FAQ)

What are the possible results of the placed trades?

There are three possible outcomes in the digital options market:1) in the event that your prognosis of determining the direction of the price movement of the underlying asset is correct, you receive income.

2) if by the time the option was concluded your forecast turned out to be erroneous, you incur a loss limited by the size of the asset value (i.e., in fact, you can only lose your investment).

3) if the outcome of the trade is zero (the price of the underlying asset has not changed, the option is concluded at the price at which it was purchased), you return your investment.Thus, the level of your risk is always limited only by the size of the asset value.

What determines profit size?

There are several factors that affect the size of your profit:

- the liquidity of the asset you have chosen in the market (the more the asset is in demand in the market, the more profit you will receive)

- the time of the trade (the liquidity of an asset in the morning and the liquidity of an asset in the afternoon can vary significantly)

- tariffs of a brokerage company

- changes in the market (economic events, changes in part of a financial asset, etc.)

How can I calculate the profit for a trade?

You do not have to calculate the profit yourself.A feature of digital options is a fixed amount of profit per transaction, which is calculated as a percentage of the value of the option and does not depend on the degree of change in this value. Suppose if the price changes in the direction predicted by you by only 1 position, you will earn 90% of the value of the option. You will earn the same amount if the price changes to 100 positions in the same direction.

To determine the amount of profit, you must perform the following steps:

- choose the asset that will underlie your option

- indicate the price for which you would have purchased the option

- determine the time of the trade, after these actions, the platform will automatically display the exact percentage of your profit, in case of a correct prognosis

The yield of a digital option is fixed immediately upon its acquisition, therefore you do not need to wait for unpleasant surprises in the form of a reduced percentage at the end of the trade.

As soon as the trade is closed, your balance will automatically be replenished by the amount of this profit.

What is the gist of digital options trading?

The fact is that a digital option is the simplest type of derivative financial instrument. In order to make money in the digital options market, you do not need to predict the value of the market price of an asset that it can reach.The principle of the trading process is reduced only to the solution of one single task - the price of an asset will increase or decrease by the time the contract is executed.

The aspect of such options is that it does not matter to you at all, that the price of the underlying asset will go one hundred points or only one, from the moment the trade is concluded to its close. It is important for you to determine only the direction of movement of this price.

If your prognosis is correct, in any case you get a fixed income.

How to learn quickly how to make money in the digital options market?

To get a profit in the digital options market, you only need to correctly predict which way the price of the asset you have chosen will go (up or down). Therefore, for a stable income you need:

- develop your own trading strategies, in which the number of correctly predicted trades will be maximum, and follow them

- diversify your risks

At what expense does the Company pay profit to the Client in case of successful trade?

Company earns with customers. Therefore, it is interested in the share of profitable transactions significantly prevailing over the share of unprofitable ones, due to the fact that the Company has a percentage of payments for a successful trading strategy chosen by the Client.In addition, trades conducted by the Client together constitute the trading volume of the Company, which is transferred to a broker or exchange, which in turn are included in the pool of liquidity providers, which together leads to an increase in the liquidity of the market itself.

What is a trading platform and why is it needed?

Trading platform - a software complex that allows the Client to conduct trades (operations) using different financial instruments. It has also accesses to various information such as the value of quotations, real-time market positions, actions of the Company, etc. Conclusion: Unlock the Full Potential of Digital Options Trading on Quotex

Logging into Quotex and starting digital options trading is a straightforward process, but mastering it requires strategy, patience, and practice. By following these steps, you can easily log in, navigate the platform, and start trading a variety of assets. Whether you are a beginner using the demo account or an experienced trader, Quotex provides the tools and features to make your trading experience seamless and profitable.